How to Thrive in Uncertain Times

Are media companies getting used to the permacrisis, the ongoing scenario where a new crisis is always looming? Or is there a way to effectively grow revenue without succumbing to contradictory business realities?

That’s the conundrum that media firms are facing as they attempt to navigate times of decreased spend and focus on higher profitability while still serving customers with efficient processes and productive talent. However, unless companies understand how to effectively maneuver these four levers – profitability, productivity, processes and people – they may not be able to achieve the high levels of growth they desire.

Go-to-Market Levers

Profitability

Addressing Underlying Challenges

A global advertising forecast recently indicated a projected 5% slowing in North American ad spend growth rate for 2023. Despite this slow down, over half of media companies are focusing on greater profitability for 2023, and 60% are projecting profitability to increase. How are these firms balancing reduced spending yet expecting to increase profitability? The answer lies in looking deeper at profitability drivers and finding new ways to address underlying issues.

The Growth Profitability Conundrum of 2023

Media firms need to focus on pulling the right levers to achieve strong profitability goals among shrinking ad budgets.

Projected slowing in North American ad spend growth rate in 20231

Media companies reporting increased focus on profitability in 20232

Media companies projecting profitability to increase in 20233

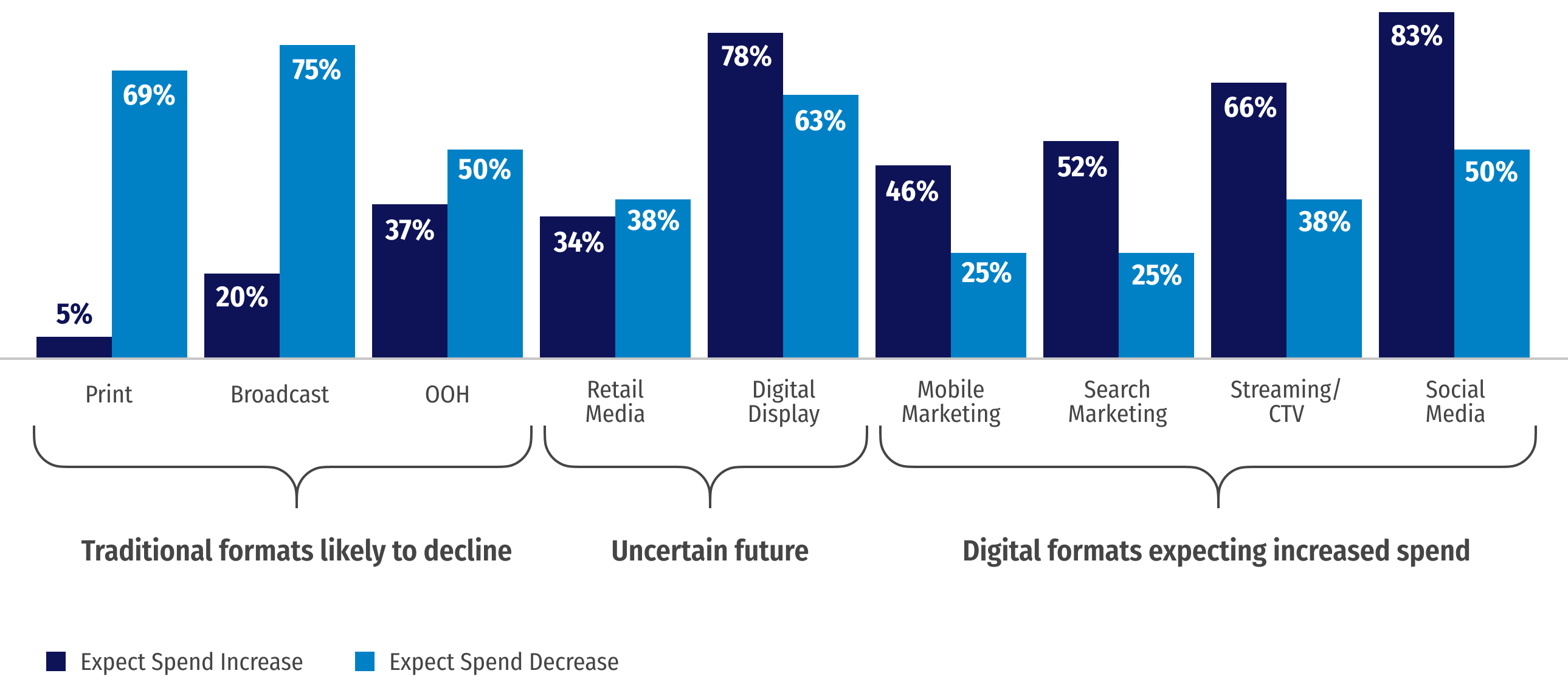

Digiday: Agency Spend Expectations for 20234

A 2022 Digiday Media Agency Report revealed where customers are spending their money. Digital formats, including mobile marketing, search marketing, streaming/CTV and social media expect to experience increased spend, while traditional formats, such as print, broadcast and OOH, will likely see a decrease. There is, however, uncertainty around retail media and digital display.

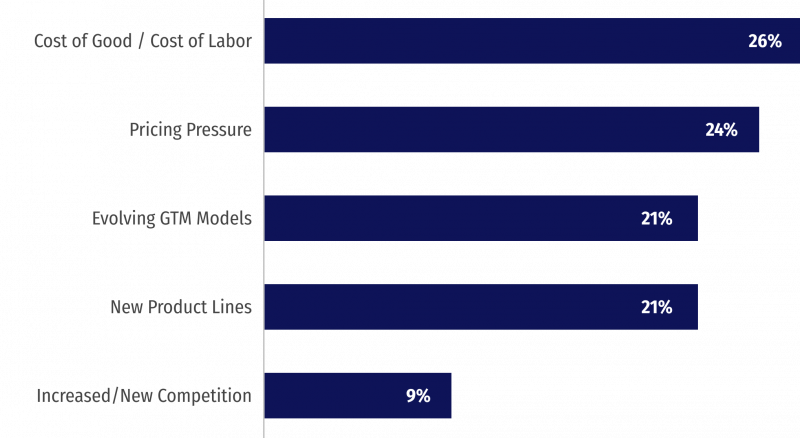

Analyzing spend is critical but understanding cost drivers is also essential. 26% of firms reported that the primary driver of decreased profitability is the cost of labor, followed by 24% that are incurring pricing pressures. Evolving go-to-market (GTM) models and new product lines also played a significant role, with 21% of companies reporting these drivers as primary profitability challenges.

Increasing Input Cost (Goods, Labor) is the #1 Profitability Driver

But companies can only gain understanding of these drivers by using the proper metrics. For example, most firms evaluate profitability using net revenue and total revenue metrics. However, to assess deal profitability, firms turn to margins, product mix and pricing.

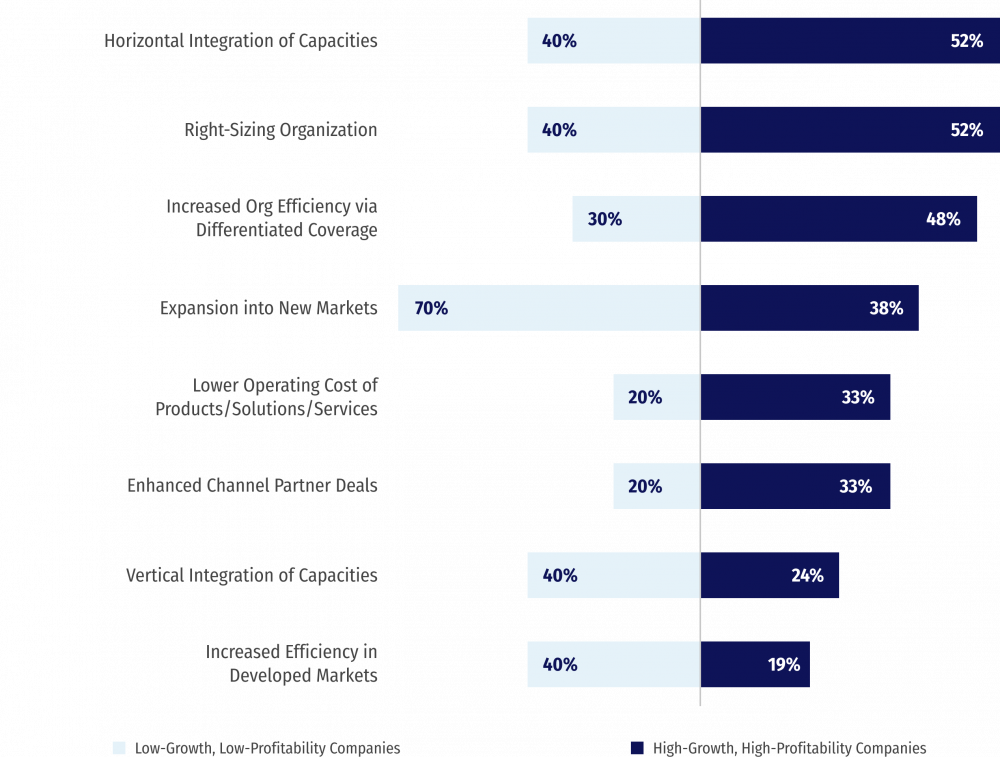

The most telltale difference in profitability is revealed when comparing high-growth, high-profitability companies versus low-growth, low-profitability companies. While both categories place primary importance on the horizontal integration of capacities and right sizing the organization to drive profitability, there is a notable difference between their investments. Low-growth companies heavily depend on expansion into new markets, with as many as 70% of firms depending on this approach to increase profitability. Conversely, only 38% of high-growth, high-profitability companies rely on new market expansion. Approximately 40% of low-growth, low-profitability companies use vertical integration of capacities and increased efficiency of developed markets compared to high-growth high-profitability firms.

Marked as top 3 focus areas to drive growth6

Clearly, understanding profitability drivers, metrics and strategies will be significant drivers for profit growth.

Case Study: Profitability

For one global DSP provider, leaders ranked organizational efficiency and client-product fit as measures to drive profitability. With that focus, client coverage and segmentation played a significant role in this company’s plans for efficient revenue growth. Customer segmentation and buying habits are essential to deploying the right sales resources and supporting a common leadership goal to “right-size” the organization.

In this instance, analytics revealed that this global leader generated 99% of revenue from fewer than 20% of its accounts. By instituting automated and minimal touch account support, they could effectively serve the other 80% (over 18,000 accounts) of customers which were previously not a focus area for growth. Ultimately, fine-tuning segmentation efforts had the potential to serve customers more efficiently and increase profitability via differentiated coverage strategies.

Analytics revealed that this global leader had nearly 70 accounts that drove two-thirds of total spend

Productivity

Investing in the Right Systems and Tools

In 2022, media firms saw a 5% higher seller productivity without a change in headcount. In addition, companies that were in the top 75% of revenue operations investment experienced 13% higher growth. However, media firms must monitor and optimize sales support investments to sustain high productivity.

In 2022, Media Firms Saw Higher Seller Productivity

Typical Change in Productivity between

2021-20225

Additions in Typical Seller Headcount

Higher Revenue Growth Achieved by Companies in the Top 75% of Revenue Ops Investment6

Media companies use three types of metrics to evaluate productivity:

Revenue and cost, including revenue per seller, revenue growth rate, percent revenue from new products and customers and sales expense per revenue dollar or seller

Roles and coverage, including the span of control, field-to-inside ratio, support roles and seller turnover

Compensation, including base pay, variable pay, pay mix and total compensation

In addition to these metrics, media firms remain hyper-focused on delivering as promised, even as budgets tighten. However, solving productivity challenges requires companies to embed a clear charter for Revenue Operations outlining tactical and strategic responsibilities, including enablement, management and strategy. As firms move toward greater digital enablement of sales and revenue operations, they must employ the right systems and tools to not overwhelm the organization with too many tools and insights. Focusing on the investments that maximize ROI and customer adoption is essential.

Case Study: Productivity

One leading digital advertising company discovered they were not consistently executing defined sales motions. Similar buyers were handled differently with no rationale for why, causing sales teams to be less efficient and unable to achieve their strategic and revenue goals.

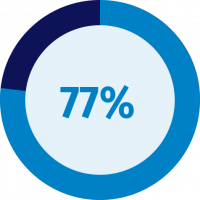

Segmenting and analyzing customer types and product needs allowed the firm to develop clear customer rules of engagement and support. While large accounts were only 16% of the total account list, they drove nearly 77% of platform spend. Differentiated approaches for different sized clients were needed to drive increased productivity.

The firm began systemizing support for different clients in different segments. They leveraged self-service programmatic options to drive higher spending volume which required less support per account for smaller accounts, created vertical-specific playbooks for medium sized accounts, and engaged more as consultative sellers & strategic advisory partners for large accounts. The firm was able to utilize the saved time by tailoring solutions to the clients’ needs, increasing revenue, and reducing time spent on non-revenue generating tasks.

Defining customer types, segmenting product offerings, updating coverage models and employing appropriate enablement tools increased productivity and revenue for this global leader.

Detailed analytics revealed that 16% of accounts drove nearly 77% of platform spend

Processes

Maximizing Customer Lifetime Value (CLTV)

Process improvements across revenue motions can maximize customer lifetime value (CLTV), leading to greater profitability. However, it does require the entire commercial organization to focus on expanding profitable relationships. Unfortunately, some firms try to be “everything to everyone,” offering expensive sales support when an alternative, more cost-effective process would suffice.

Alexander Group’s research shows that 63% of surveyed companies generate profitability from existing products, services and solutions. In addition, high-growth, high-profit firms are 1.7 times more likely to influence profitability by using established processes that nurture pre- and post-sale stages.

Leaders Achieve Productivity Through New Processes

of surveyed companies primarily generate profitability from existing products, services & solutions7

High-growth, high-profitability companies 1.7x more likely to influence profitability in post-sales phases

Ratio of Account Executives to Account Managers in large pure play digital companies

Customers buy marketing services based on multiple reasons including necessity, convenience, price, recommendations and most importantly, value. That is why growing relationships with buyers and using the right mix of sellers, processes and services improves CLTV. High-growth companies are leveraging these relationships to ensure profitability for the coming year.

In 2018, there were 2 organic sellers for every account manager among large pure-play digital platforms. In 2023, the ratio is nearly 1:18

Case Study: Processes

After multiple mergers and acquisitions, one global producer of premium entertainment was left with an inconsistent HR structure for its team of 1,300 ad sellers. As a result, it required a new digital go-to-market (GTM) strategy and process to enable its teams to better sell.

This media leader needed to completely overhaul its GTM sales process and in order to successfully do so, it needed to transform its HR infrastructure. That scope of change included redesigning roles/ responsibilities, refreshing the GTM sales process, updating underlying pay structures (e.g., plan eligibility, pay mix and pay levels/pay bands), creating new job levels and competencies, and designing/implementing a new org-wide career management framework that built on all of the change foundation. The process redesign and adoption enabled the media leader to transform with a stable, scalable program for its sales and sales adjacent organizations.

The changes also laid a consistent foundation for future iterations of the GTM model. Detailed program governance helped to streamline any adjustments going forward. As a result, this company could enhance their competitive standing by attracting and retaining talent for its new go-to-market strategy.

A role standardization process created a new infrastructure that included a stable, scalable framework

People

Aligning Talent to Enhance Motivation and Performance

Talent has also been a puzzle for media firms throughout the past year. Firms faced the post-COVID impact of bloated budgets as they raced for talent, driving up the cost of coverage. For some organizations, it led to an isolated way of thinking about talent retention, believing that they had to pay employees more or develop a program to make them stay. Unfortunately, that approach overlooks the many elements that make job expectations clear and provide value for the company.

Media firms have endured an expensive roller coaster ride. Account manager total pay increase neared 20% as the typical percentage of workforce laid off at large media firms ranged from 15-20%. Compensation increases affected the bottom line, but so did turnover, as firms experienced an average 4% revenue shortfall for every 5% incremental turnover.

Account manager total pay increase

Typical % of workforce laid off among large media firms9

Revenue shortfall for every 5% incremental turnover10

Alexander Group People Management Model

Attract, Develop, Retain and Reward Best-in-Class Commercial Personnel while Driving Employee Engagement, DEI Goals, Customer Success and Profitable Revenue Growth

Job Design

Job design tells the employee what you want them to do in their role using a commercial strategy matrix that defines revenue growth and job roles for the entire organization while understanding each role’s bandwidth to accomplish stated goals.

Competencies

Competencies outline the experience necessary to perform the job role successfully. Competencies include education, business and industry knowledge, sales and team skills, self-development and other factors. In addition, required skills may consist of customer relationships as well as account management experience and their overall level of expertise.

Job Levels

Job levels result from the job design and the required competencies. Job families group jobs performing similar duties based on their revenue motion or process, specialization, route-to-market, deployment and job type.

Job Design

Job design, competencies, job levels and families provide the foundation for a focused and productive workforce. However, career paths are also required to motivate and demonstrate multiple career opportunities for each employee, using competencies to drive career promotions.

Eligibility

Pay Levels

Pay Mix

Leverage

Measures

Mechanics

Case Study: People

Even the most promising global media players risk continued growth without a scalable people management model. For example, one $1B streaming giant had inconsistent job roles and levels, as well as unclear competencies, which led to poor employee satisfaction. Tasked with improving their global ad salesforce satisfaction and retention, Alexander Group’s assessment included multiple business units comprising 650 FTEs, 63 job profiles and 23 job families.

By reviewing the current job architecture, collecting data for unique insights and defining the future state job architecture, Alexander Group discovered that an estimated 30% of existing jobs required job level consolidation or re-leveling. In addition, recommendations included introducing additional job roles to 25% of jobs to drive in-role progression.

The result is a straightforward job architecture framework across teams and geographic regions in addition to distinct job levels, competencies and career paths, driving increased employee satisfaction with anticipation of improved talent retention.

The integration of competencies, skills and necessary levels of expertise enables behavioral transition from selling boxes to innovative solutions in a service-led, portfolio sales motion.

Re-defining the Permacrisis

The coming year of 2023 will present new business developments, requiring media firms to act decisively amid ongoing crises. However, successful, high-growth companies that use profitability, productivity, processes and people will outperform competitors and secure their position as leaders despite new and unexpected developments.

Find out how Alexander Group can help your organization drive revenue growth.

Media Sales Overview

Media Sales Industry Trends Research

Media Advisory Council Upcoming Events

About Alexander Group

Alexander Group understands your revenue growth challenges. Since 1985, we’ve served more than 3,000 companies across the globe. This experience gives us not only a highly sophisticated set of best practices to grow revenue—we also have a rich repository of unique industry data that informs all our recommendations. Aligning product, marketing, operations and finance efforts behind a successful sales organization takes insight and hard work. We help the world’s leading organizations build the right revenue vision, transform their organizations and deliver results.

1) Magna Global Advertising Forecast

2) Alexander Group 2022 Media Advisory Council Poll

3) Alexander Group Media Profitability Research

4) Digiday 2022 Media Agency Report

5) 2022 Alexander Group Media Research

6) 2021 Alexander Group Media Research

7) Alexander Group Media Profitability Research Alexander Group Media Industry Research

8) Alexander Group Media Industry Research

9) CrunchBase & Linkedin Data on layoffs among large Media Firms since 8/1/2022

10) Alexander Group Analysis, assumes 6-month territory vacancy and new hire productivity at 50% over 6-month ramp time