Exceeding customer expectations.

Allocating resources.

Creating the right culture.

Driving growth.

These are the charter of the revenue leader. Yet, in times of significant market upheavals, revenue leaders assume a new level of responsibility.

The safety and security of team members and their families take on a heightened level of importance. Customers impacted by the upheaval may fear for their own businesses and jobs. Stakeholders in other parts of the organization look to the revenue leader to shoulder the organization through the difficulty.

With the health and safety of the team assured, revenue leaders must take steps to protect the livelihood of the organization: its revenue. Most often that involves elevating customer focus to another level; meeting existing customers on their terms and focusing on how to help them with their own businesses.

The goal: Protect the base. Protect the now.

Once the crisis passes, however, the revenue organization needs to be the engine of growth. Revenue leaders must be ready. The organizations that survive and win prioritize and capitalize on both latent and new growth opportunities.

The goal: Prepare for the after.

Revenue leaders have a seemingly endless set of decisions to make and actions to take involving product availability, marketing, distribution, coaching, training and more. What follows is an overview of the six critical levers revenue leaders should use to address both, equally important, mandates:

PROTECT THE NOW. PREPARE FOR THE AFTER.

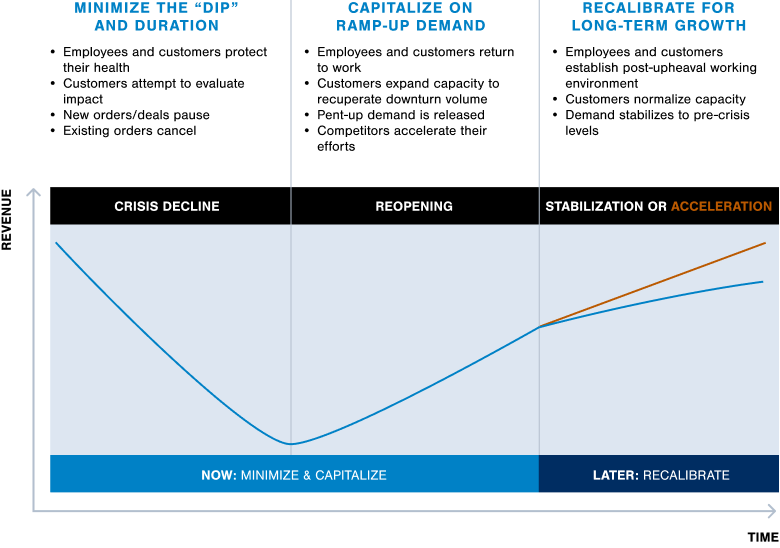

Develop a Revenue Growth Plan that Navigates Disruption While Considering Long-Term Implications

Degrees of upheaval will vary by industry; revenue leaders must be prepared for the speed of decline and re-opening.

Companies that Deploy Six Revenue Growth Levers will Reemerge Stronger

NOW:

MINIMIZE & CAPITALIZE

LATER:

RECALIBRATE

Validate and rank high impact accounts

Reevaluate customer segmentation and targeting strategy

Recalibrate messaging for disruption sensitivity and shifted customer priorities

Update based on long-term changes in buyer personas

Update customer engagement model and adopt a Customer Success mindset

Evaluate permanent shift toward more efficient (or effective), now-proven models

Manage costs while maintaining capacity for reopening

Rethink previously established investment levels and priorities

Determine near-term adjustment plan

Align sales compensation plans to new strategic priorities

Deploy real-time reporting/management and accelerate digital investments

Perform post-crisis process and infrastructure evaluation

1. Account Prioritization

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Validate and rank high impact accounts

- Prepare crisis-impact indices for all customer segments, including new and existing buyers

- Establish high priority account lists by seller

- Build segment and/or account specific mitigation plans

- Modify account plans

Why?

In order to minimize decline and capitalize on the upturn, companies need to be hyper-focused on customers that will “move the needle” the most. Sellers should be given explicit guidance on where to spend their time.

Reevaluate Customer Segmentation Strategy

Determine the customer segments with long-term impact (positive or negative). Reevaluate buyer behaviors by segment. Update opportunity data inputs, account level opportunity estimates and buyer needs assessments, which may inform a new targeting strategy.

Why:

The customer landscape has changed. Buying processes and industries may be fundamentally altered. Pre-crisis segmentation and targeting strategies are likely outdated.

Example Account Prioritization Framework – Current Impact & Resilience for Industries Served

2. Value Proposition Messaging

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Recalibrate messaging for disruption sensitivity and shifted customer priorities

Determine the personal and professional impact on your customers

Create current state buyer needs assessments

Revise value propositions to align with current buyer needs while maintaining clear differentiators

Quickly develop actionable playbooks for sellers that incorporate specific messages

Why?

In times of disruption, customers may be experiencing a volatile economic environment that impacts them both personally and professionally; the use of pre-crisis messaging will likely come across inconsiderate and unaware.

Update based on long-term changes in buyer personas

Update buyer personas to include permanent personal or business triggers. Reevaluate competitive differentiators and alignment with buyer needs in updated customer segments.

Why:

Effective value propositions are measurable, differentiated, aligned with buyer needs and simple to convey… these components may be permanently changed by the upheaval.

3. Customer Engagement Model

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Update customer engagement model and adopt a customer success mindset

Determine the extent to which existing roles are impacted

- Are employees still able to do their job effectively?

- How is their time profile changing?

- Are customer needs still being addressed?

Rapidly adjust roles to adapt (e.g., shift resources and communicate inside sales best practices broadly)

Reset expectations for field sellers activities (e.g., number of high value calls, using video conferencing)

Shift outreach messaging to crisis-sensitive topics

Why?

Core processes and engagement approaches may be impacted. Companies who are best able to support their customers and establish themselves as trusted advisors during the disruption will experience greater customer retention or expansion later.

Evaluate permanent shift toward more efficient (or effective), now-proven models

Conduct comprehensive evaluation of external buyer journeys and preferences as well as internal Customer Success capabilities. Adapt coverage model to align with permanent shifts in buyer behaviors, learnings from crisis phase virtual engagement, and refined customer segmentation.

Why:

- We’ve learned new ways of working that in some cases should remain intact long-term because they’re more efficient, more effective, or both.

- Buyer behaviors have changed and our long-term strategy has been recalibrated; coverage strategy and roles must adjust.

Example Coverage Model Change:

Seller Role Responsibilities Shifted During Crisis and Should be Evaluated After

4. Cost Structure

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Manage costs while maintaining capacity for re-opening

Evaluate near-term shifts in opportunity (and seller workload) between served segments

Prepare short-term and long-term workload models by role to ensure appropriate resource mix

Optimize near-term headcount by role while being mindful of “re-open demand”

Prioritize programmatic investments (training, tools) that could be delayed without sacrificing return to growth

Why?

Near-term costs need to be managed but companies should be structured to effectively to capitalize on “reopening phase” demand.

Rethink previously established investment levels and priorities

Evaluate investment profile within and across customer segments, including headcount ratios, infrastructure, enablement programs and other related costs. Based on the updated strategy, customer segment opportunity and role responsibilities determine maintain, reduce or scale investment levels. Consider pulling delayed programmatic investments forward to accelerate scale if warranted.

Why:

The crisis exposed areas where we can “do more with less” and/or accelerate the shift toward greater digital engagement. Resource and investment levels should be evaluated when markets stabilize.

5. Compensation & Quotas

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Determine near-term adjustment plan

Consider keeping sales personnel “whole” or “partially whole” so they do not suffer from a financial shortfall caused by factors outside of their control

Avoid techniques that encourage sellers to take a sellers’ holiday”

Consider solutions such as: guarantee, quota reduction, bridge performance, index performance, team rewards, SPIFs

Prepare for reviews with finance by creating dynamic compensation cost models that factor in rehiring expenses.

Why?

The crisis has created a substantial performance variance to prior forecasts. Companies should adjust sales compensation plans and quotas to account for the external economic shock. Sales compensation is not a variable cost to be managed down unless the ongoing viability of the business is at stake. Sales talent will be the engine to propel growth as market conditions improve.

Align sales compensation plans to new strategic priorities

Review current sales compensation plans and update them to align with revised strategy, roles and performance expectations.

Why:

The crisis changed the environment to the extent where companies will potentially reestablish a vision, segmentation strategy, coverage and roles. Sales compensation plans should be updated to align with revised strategy and role objectives.

6. Operations & Infrastructure

NOW: MINIMIZE & CAPITALIZE

LATER: RECALIBRATE

Deploy real-time reporting/management cadence & accelerate digital investments

Create expectations/processes for daily CRM updates

Establish daily senior level forecast reviews and increase frequency of seller level reviews

Recalibrate dashboards to capture 3-5 key metrics in the new environment

Accelerate the use of new social media platforms, digital purchasing and other digital tools

Why?

Rigorous forecasting will help monitor revenue impact as well as create an “all hands on deck” approach to key opportunities.

Perform post-crisis process and infrastructure evaluation

Evaluate the operational gaps (or opportunities) the crisis exposed and those that should be addressed for the long term. Consider broader deployment of digital engagement that proved valuable or missing during the crisis. Revisit how

the operations team charter of deploying the right tools, automating processes and driving strategy change can be best leveraged.

Why:

The crisis may have uncovered gaps or new opportunities to address. Alternatively, it may have exposed effective digital tools that previously had limited use.

Leadership

Stretching across the levers and underpinning the success of the organization is leadership. Two proven principles should be remembered throughout the upheaval and beyond:

1. Over Communicate

Revenue leaders, in fact leaders in general, must recognize that customers, partners and employees will remember a firm’s response to the upheaval. They’ll remember what you say and do after the crisis is over, without regard to the eventual duration, severity and scope of the disruption.

Internally, communicating clear expectations on what must change and why is one of the leader’s primary responsibilities. This includes expectations for performance outcomes but also how people spend their time, including the day-today “on-call” cadence with customers.

2. Balance Empathy With Sense of Urgency

Empathy is defined as the ability to understand another person. Empathy is critical when various constituencies are dealing with a range of personal and professional challenges. But team members

also need to understand there is a sense of urgency during the disruption. Urgency to ensure the health and safety of the team. Urgency to protect the base. Urgency to be ready when the disruption passes. A strong leader can provide empathy and ask for urgency at the same time.

Conclusion

Market upheavals can have both short-term and lasting impacts on employees, customers and the companies go-to-customer model.

Those companies that balance short-term priorities of safety, viability and customer success will be in the best position to accelerate and win long-term.

The six growth levers, coupled with strong leadership, represent the core actions revenue leaders should take to successfully navigate a tumultuous marketplace.

Proven Methodology to Accelerate Sales

Enduring Leadership: Eight Tenets for Revenue Leaders

The Digital Revenue Organization: A Watershed Moment

About Alexander Group

Alexander Group understands your revenue growth challenges. Since 1985, we’ve served more than 3,000 companies across the globe. This experience gives us not only a highly sophisticated set of best practices to grow revenue—we also have a rich repository of unique industry data that informs all our recommendations. Aligning product, marketing, operations and finance efforts behind a successful sales organization takes insight and hard work. We help the world’s leading organizations build the right revenue vision, transform their organizations and deliver results.