With core revenues continuing to decline year-over-year, sales leaders must make quick and decisive decisions regarding what products to sell, where growth will come from, who will sell what product to which customer.

Incentive dollar misallocation occurs when sales rewards do not align with business objectives and desired sales tactics. Many sales organizations rely on suboptimal volume-only sales compensation plans. This paper will use the media advertising industry to illustrate several ways in which organizations misuse critical sales compensation dollars.

Sales organizations are dynamic and rapidly changing entities. Over time, they must quickly adapt and respond to changes in corporate strategy, business objectives and external factors. Market realities and sales model decisions have significant impact on incentive plan effectiveness and alignment.

The sales entities of traditional (print and broadcast/cable) media advertising companies are facing immediate challenges. With core revenues continuing to decline year-over-year, sales leaders must make quick and decisive decisions regarding what products to sell, where growth will come from, who will sell what product to which customer. In addition, these companies must stay relevant during the print-to-digital product conversion and avoid displacement by digital media advertising competitors such as Google, Facebook, Amazon and cable multiple system operators.

There are four major challenges traditional media advertising companies face today:

- Product Expansion or Displacement: Staying relevant while new, lower dollar value products expand and core product revenues decline.

- Identifying Growth Opportunities: Defining customer segments with the highest growth potential. With core revenues continuing to decline year-over-year, sales leaders must make quick and decisive decisions regarding what products to sell, where growth will come from, who will sell what product to which customer.

- Sales Representative Productivity and Headcount: Retaining current sales model or modifying to accommodate new products or customers.

- Increased Competition: Competing with new, more agile entrants into the marketplace.

Traditional print/broadcast companies must evolve their sales teams. Any adjustments to sales models require an update to the sales compensation program. Absent a comprehensive review of the sales compensation plans, minor tweaks and incentive add-ons could cripple the sales compensation plan and, thus degrade the sales department’s effectiveness.

With senior management asking more and more of their sales organizations, it is imperative to align incentive payments and costs with results. As budgets tighten and strategies change, sales leaders must demonstrate return on investment by showing how incentive dollars drive business objectives. For example, if all or more of the sales compensation budget is paid out when the overall company results are below forecasts, then it is time to investigate the sales compensation program.

However, accounting for all incentive payments is often a difficult audit process. Look here for the six most common ways traditional media sales departments have misused sales compensation dollars.

Common sales compensation misallocations include:

- Proliferation of SPIFs and product commission rates

- Transaction selling instead of solution selling

- Errors of tiered commission schedules

- Retroactive “dollar-one” commission rates

- Incorrectly incenting for team sales efforts

- Salary in disguise

An Alexander Group client in the media advertising industry with declining core revenues year-over-year relied heavily on SPIFs (special performance incentive funds) and special product rates for seasonal events. These add-on incentives tend to reward important strategic products, which have low-dollar value. Each quarter, the sales force would receive an Executive Memo from sales leadership, detailing the updated commission rates for up to nine specialty or niche products and events. Sales leadership really wanted the sales force to focus on sustaining core revenues as its primary objective. Better sales of strategic products was an important but secondary objective. Unexpectedly, they found, through manager feedback, that sellers were overwhelmed by the array of additional rates and were not certain about where to focus their efforts.

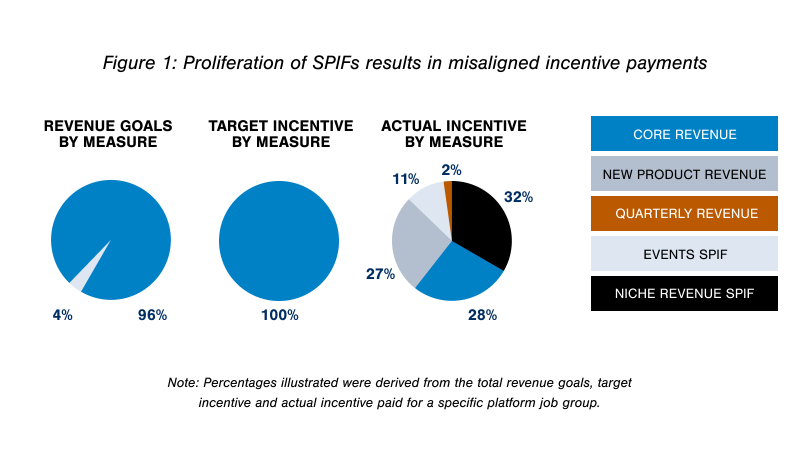

Figure 1 illustrates the issue. In the first pie chart, “Revenue Goals by Measure,” the client is expressing its business goals clearly through its incentive weightings: core revenues (96% weight) and new product revenues (4% weight). The second pie chart, “Target Incentive by Measure,” shows all target incentives were allotted to core revenues. However, the third pie chart, “Actual Incentive Paid by Measure,” illustrates the total incentive paid, including events, SPIFs and niche revenue, totals 43% of total incentive earned. This outcome does not align with the business emphasis of core revenue. In other words, incentive paid out to sellers was not aligned with the company’s business goals. This graphic illustrates that although sales leadership has communicated a specific strategy, incenting for several different revenue streams outside of the compensation program can be distracting to the sales force. It’s a clear example of incentive payment leakage.

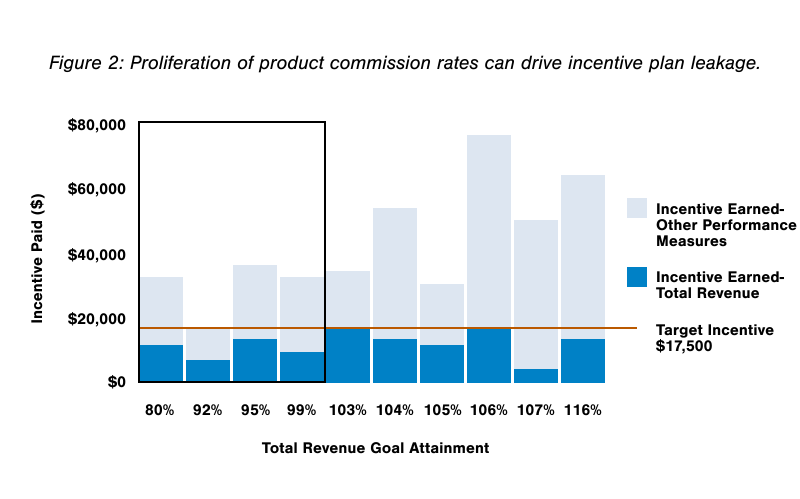

Another example of incentive dollar misallocation is seen in Figure 2. In this example, the same client paid out more than 100% of target incentive for below core revenue performance 40% of the time. What’s more, nearly every salesperson in this example was able to double, or even triple, his/her incentive earned through add-on product commission rates outside of the plan. These product-by-product commission rates made it easy for representatives to pick and choose how they earned their incentive and ignore the business’s main objectives.

Rather than using an open budget approach to offering incentive and SPIF dollars, begin with a target incentive then allocate it to the various goals. This approach will help contain excessive use of dollars away form the core business objectives.

Misuse #2: Transaction Selling Instead of Solution Selling

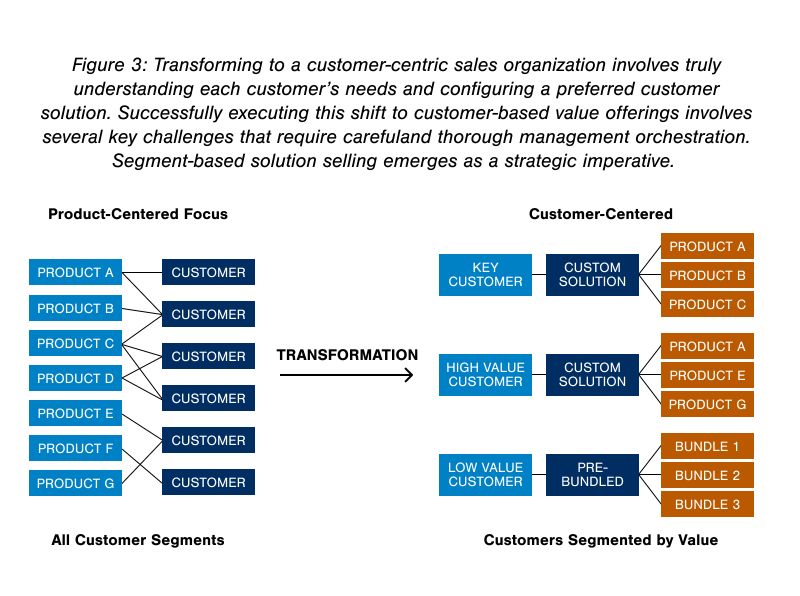

A company’s go-to-market strategy will shift over time due to the changing needs of the customers, new product introductions, legacy product displacement and ever-present competitor challenges. Businesses that are historically high transaction-based are shifting to high-value solution selling. As a longer, more complex sales cycle emerges requiring more customer engagement, the sales compensation program will need updating.

Misuse #3: Errors of Tiered Commission Schedules

To accommodate for unequal opportunity among a group of sellers, some companies employ a tiered commission rate structure. The term tiered refers to a payout schedule in which different commission rates are assigned based on a predetermined factor such as territory size, account base or customer type.

These predetermined factors are not necessarily stagnant. As revenue grows, one method to keep compensation levels consistent with market rates is to reduce the size of territories by reallocating accounts to other or new sellers. If territories are not adjusted, sales management must reduce the seller’s current commission rate to acknowledge the larger revenue responsibility and preclude excessive commission earnings. The latter creates a troublesome scenario for several reasons First, the new, lower commission rate often demotivates the sellers. Each time the employee grows his or her territory, he/she exclaims: “Every year, I grow my territory, but my commission rate goes down.” Secondly, a tiered commission rate schedule may deter sellers from growing their territory because it impacts their incentive opportunity. Given the chance, sellers may choose to manage their territories to avoid being assigned a lower commission rate.

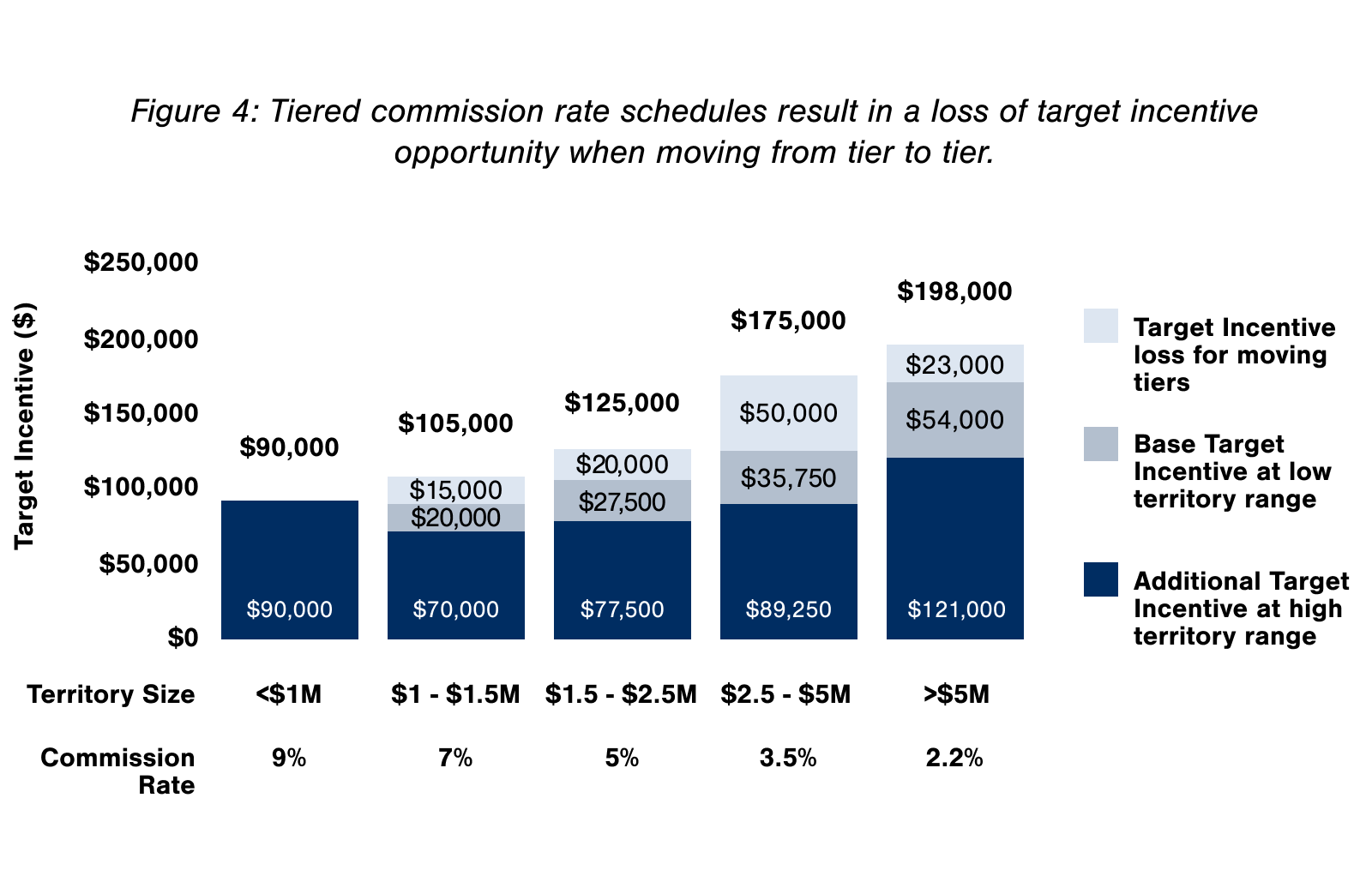

Figure 4 illustrates the maximum target incentive opportunity for a group of sales employees with significantly different territory sizes. The target incentive opportunity is calculated based on the high-end of the territory size (e.g., $1 million to $1.5 million territory size yields a maximum target incentive opportunity of $105,000 by taking 7% x $1.5 million). The x-axis shows the territory size ranges. Below the x-axis is each territory’s associated commission rate. The y-axis represents the maximum target incentive opportunity. As seen below, incentive opportunity changes as territory size increases. In this scenario, if a seller grows a territory from $900,000, to just over $1 million, he/she is assigned a lower commission rate. As a result, the target incentive opportunity also declines. Before growing the territory, the seller had a target incentive of $81,000 (9% x $900,000). With the new, lower commission rate, the seller’s target incentive opportunity is now $70,000 (7% x $1 million), creating a deficit of $11,000. Facing this prospective loss of income, sellers may refrain from aggressively growing their territories to avoid being penalized by a new, lower commission rate.

Misuse #4: Retroactive “Dollar-One” Commission Rates

A “dollar-one” plan will pay a flat commission rate on all sales revenue generated depending on achievement of a predetermined factor (e.g. specific product or overall sales generation). The mechanic of retroactive dollar-one commission rates rewards the sales personnel a lower commission rate for sales below quota and a higher rate above quota. The retroactive dollar-one commission rates “revalue” the commissions paid below goal with the new above goal commission rate when the seller reaches goal. The outcome is a substantial payout for the last incremental sale upon reaching goal.

A plan structure that employs retroactive, dollar-one commission rates may actually discourage sellers from achieving excellent performance beyond goal because of the satiating effect of the large payout that occurs at goal attainment.

This approach may unintentionally suppress performance beyond goal attainment. Because of the potentially large difference in incentive payouts below and above goal achievement, sellers may feel compelled to stop selling after achieving goal. After driving revenue just slightly above 100% of goal, a seller may stop growing revenue as he/she collects a substantial payout. Evidence of this problem occurs when an unnatural cluster of sellers perform just slightly above goal. In some negative instances, the total incentive payments may exceed the incentive budget without reaching or exceeding company objectives.

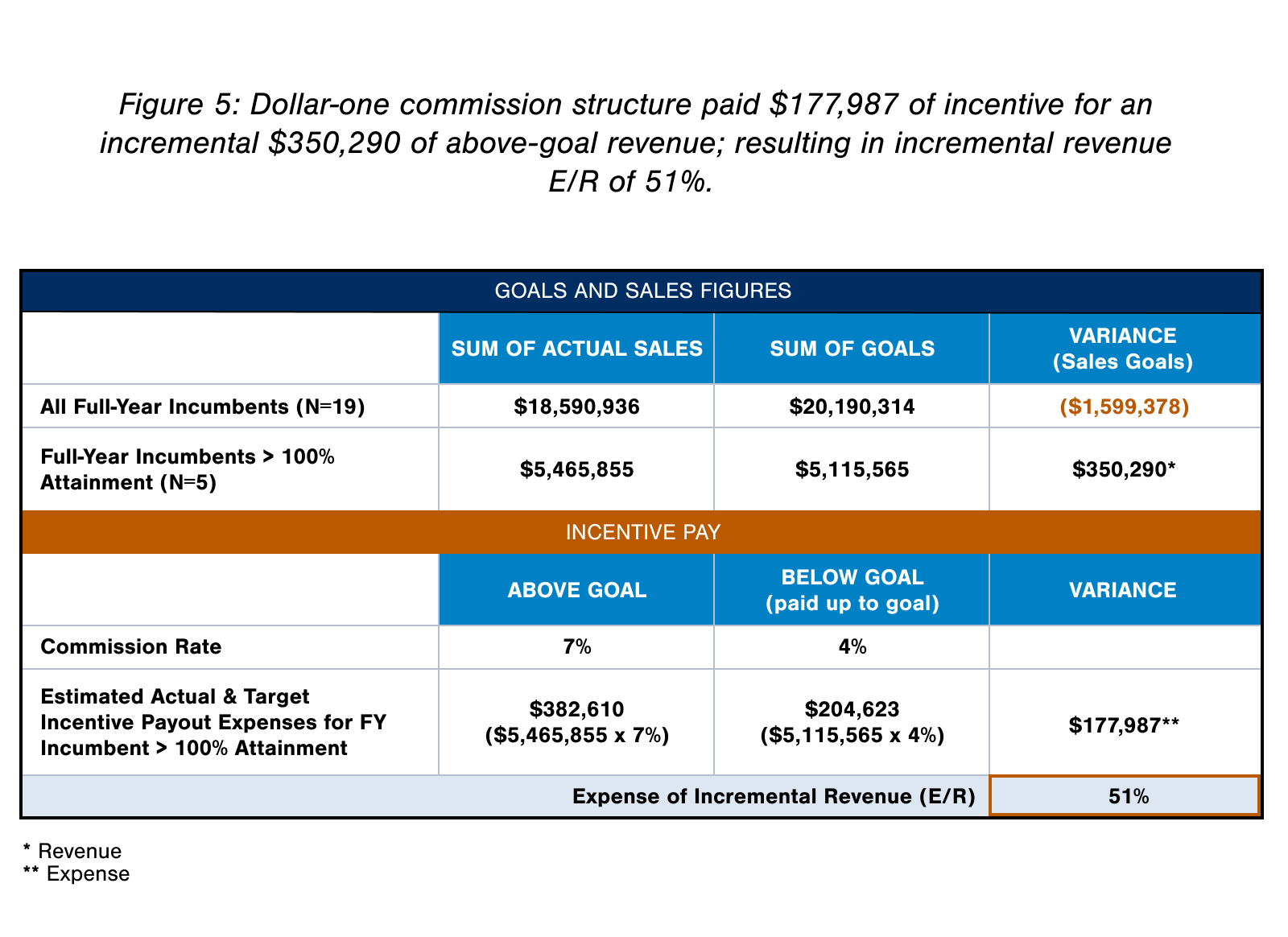

In the example illustrated in Figure 5, sellers are eligible for a 4% commission on all sales below 100% of goal and paid a 7% commission rate on all sales (retro to dollar one), if they reached or exceeded their goal. The added 3% commission rate on top of 4% for below quota performance at time of achieving quota encourages sellers to reach their goals. However, once they reach goal, they are paid a generous incentive as the higher commission rate is applied to below quota performance. In our example, a payment up to $30,000 at goal achievement could effectively cease aggressive sales activity. In Figure 5, only 26% of sellers in the assigned analysis group performed above goal. The company did not meet its top-line goal. For those over-goal achievers, an incremental $350,290 in revenue was generated. However, an incremental $177,987 in incentive was paid to sellers, resulting in an incremental Expense to Revenue ratio of 51%; simply too excessive a cost for the revenues realized.

Dollar-one commission rates can promote undesirable selling behavior. Management must weigh the benefit and cost of paying dollar-one payments for modest revenue performance.

Misuse #5: Incorrectly Incenting for Team Sales Efforts

An integrated media company selling traditional print, broadcast and digital advertising decided to reward sellers to sell as a team by offering a cross-media commission rate on each sale that included all three types of media. Teaming on sales was a strategic direction the company wanted to explore. All sellers were on a commission-only (0/100) plan design and advertising sales opportunity across the media products varied greatly. Print sellers faced declining year-over-year revenues while broadcast sellers were able to aggressively sell, and win, new client opportunities. In addition, the client deployed a digital product specialist that teamed with both print and broadcast sellers on appropriate opportunities. All digital products had aggressive growth expectations and sellers across the business units were attempting to place digital products where they could. At the outset, the client felt that by adding an additional team commission rate onto each print, broadcast and digital sellers’ compensation plan would appropriately drive a team sales approach.

Unfortunately, adding an additional cross-media or team selling commission rate resulted in undesirable sales behavior. Instead of bringing in teammates to assess a client’s needs for the most appropriate opportunities, print and broadcast sellers exploited the commission rate by tagging on small amounts of print, broadcast or digital products to all orders so as to meet the loose requirements for a cross-media sale. As a result, the Company paid out large commission checks for sales that were not truly a team effort.

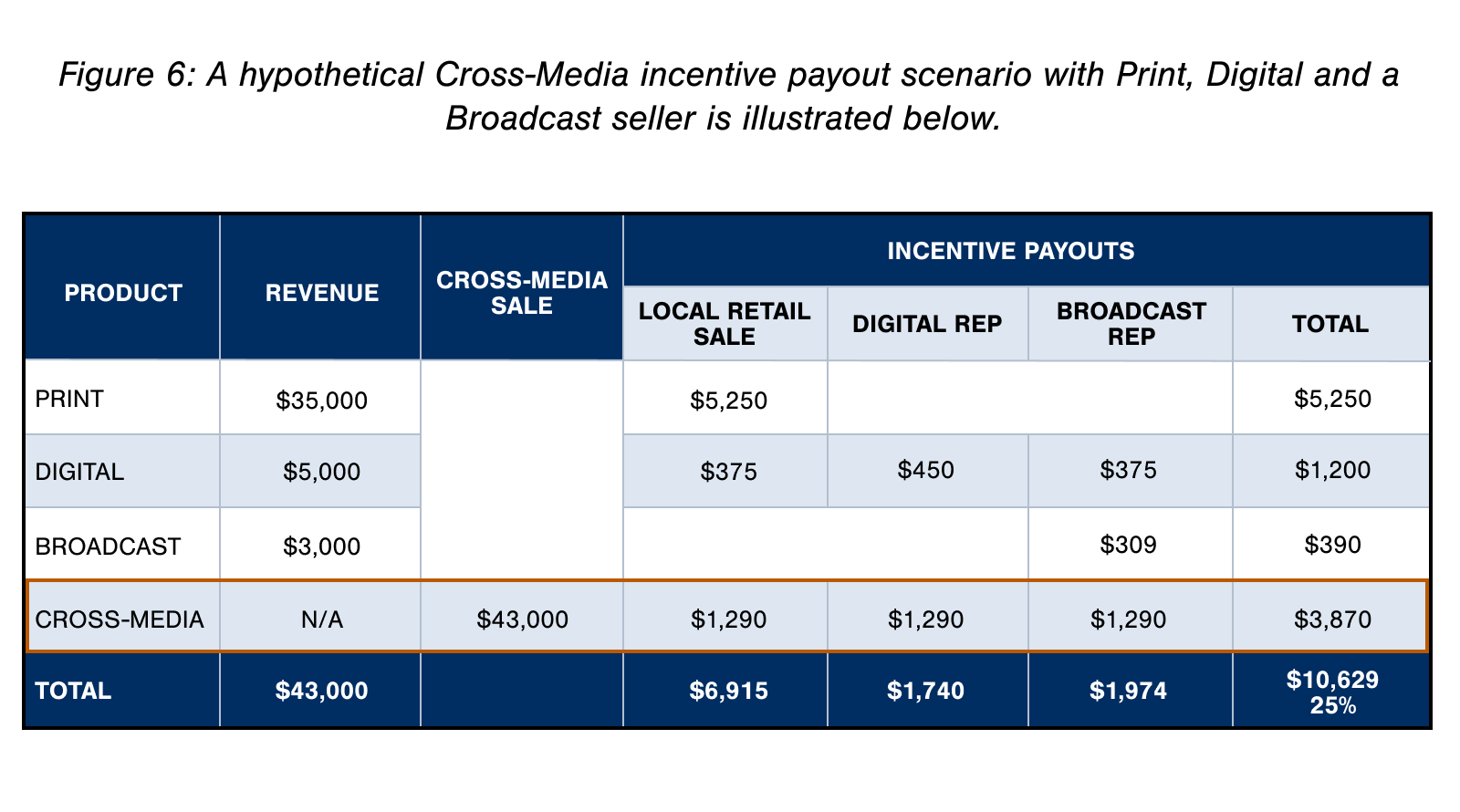

In the hypothetical example shown in Figure 6, a team consisting of a print and broadcast seller and a digital product specialist make a cross-media sale. The sale consists of very little broadcast, just 7% of the total sale, with print accounting for the majority. Regardless of the sales effort by each individual, each party is given an additional 3% commission on the total cross-media sale. The resulting Expense to Revenue ratio for the small sale is nearly 25%.

As mentioned previously, adding on an additional team commission rate in hopes of changing the sales force’s selling tactics can result in undesirable behavior, gaming of the system and overpayment of incentive dollars. In addition, the very nature of 0/100 commission plans can inhibit team-based selling.

Misuse #6: Salary in Disguise

Many sales leaders believe withholding base salary is the best way to motivate their sales forces to sell aggressively and keep delivering results. However, companies that have high annuity or recurring business and do not employ achievement thresholds may already be paying for a salary—a salary in disguise.

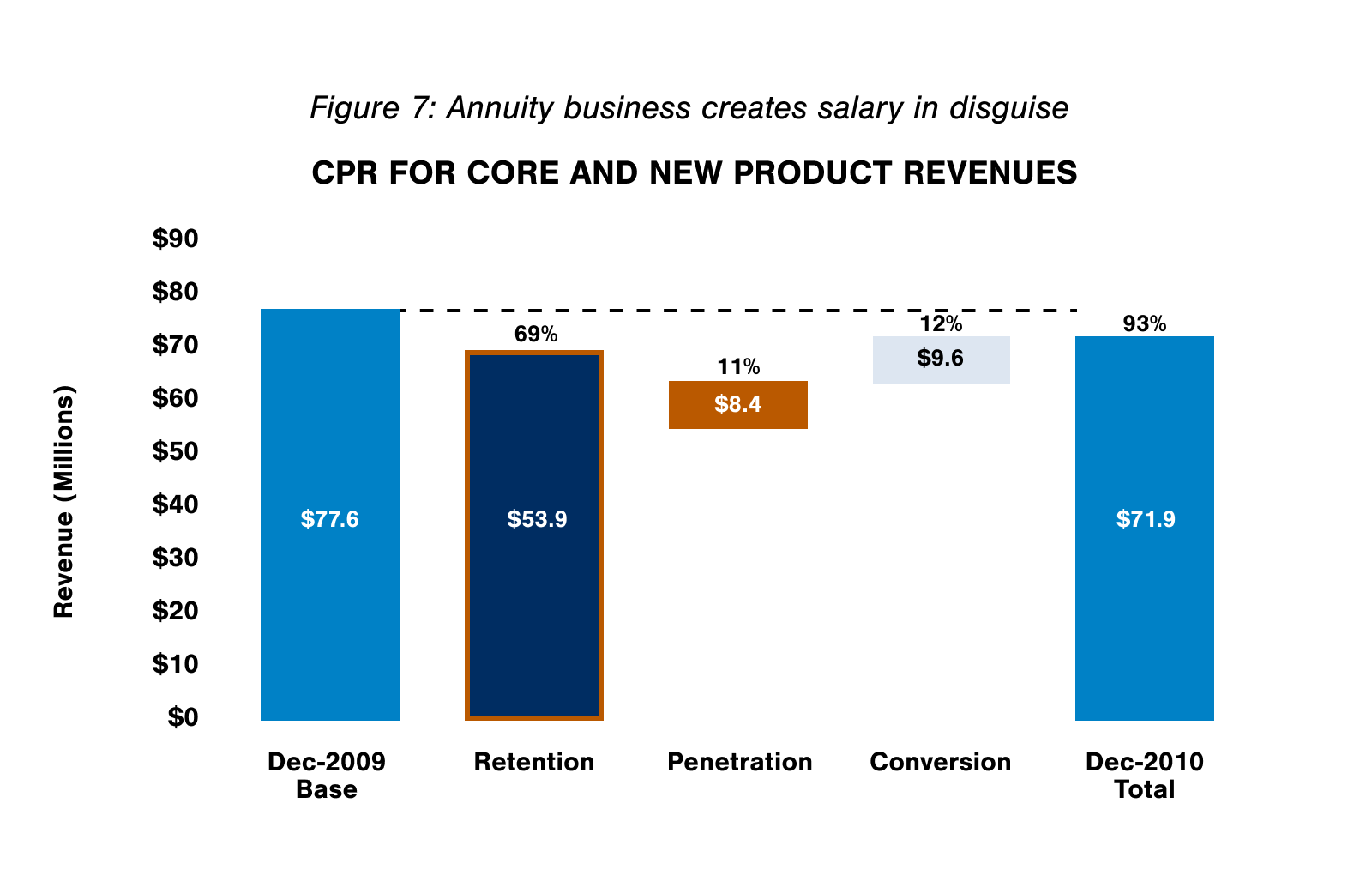

Figure 7 shows that nearly 70% of a client’s year-over-year revenues came from retention sales. This annuity business is simply another form of a base salary. No matter the seller’s sales effort, at least 70%, or more, of revenue was going to come in each month. In this scenario, a seller could make half, or more, of his/her total earnings without much more than putting in a call to make sure the client is happy. Instead of instilling a sense of “hunger” or sales drive, the 0/100 plan design with no threshold only made it difficult to recruit and retain top talent.

By instituting a base salary, even if it is small with a sales threshold, sales leadership could more closely tie their sales compensation investment to true territory management and growth.

Conclusion

Sales leaders must ensure their sales compensation program and investment aligns with the desired go-to-market strategy and future growth strategies. Typically, companies and industries such as traditional media advertising employ volume-based plan designs that support shorter, transaction-focused sales cycles. In order to stay relevant, sales organizations must become less product-centric (e.g., focusing on “comfort zone” products or ignoring products or solutions they are not adept at selling), and look at customers in terms of life-time value. By designing goal-based programs that emphasize overall revenue growth, strategic, consultative selling and pay based upon aligned performance, sales leaders can begin to get more from their sales.