Introduction

In recent years, revenue leaders have tried to define the digital downstream impact on marketing, sales and service organizations. Google made buyers instant experts. Amazon reset customer expectations. Social media went mainstream. This new business-to-consumer world has also changed what it means to engage customers in a business-to-business environment.

Two decades after the dot-com boom, revenue leaders understand the need to evolve. But where do they start? Lack of clear digital definitions, ultra-focus on quarterly growth goals, limited budgets, and competing priorities has slowed the pace of change.

Then came the COVID-19 pandemic. Nature brought us clarity and a case for rapid change. March 2020 will mark a time when global revenue organizations experienced a watershed moment–leading to a clear definition of the Digital Revenue Organization.

With the onset of the pandemic, vendors and their customers were forced into remote work. Marketing events were canceled, in-person meetings moved virtual and service appointments postponed. Business slowed, but didn’t stop. Vendors and customers learned on the fly, quickly figuring out how to leverage technology to engage. The tools already existed and many already had the skillsets.

The revenue organization simply needed a catalyst.

Things Will Never Be the Same

Revenue leaders have learned too much to return to the pre-March 2020 operating model. Even if they wanted to—buyers won’t allow it, sellers won’t want it and finance will prevent it. The new operating model is better aligned with buyer preferences. It offers a stronger employee value proposition and a more attractive, scalable cost structure.

BUYERS

Human nature will always demand a certain level of face-to-face interaction. As social animals, people will want to engage in-person. However, people also like choice and convenience.

As the economic environment turns, buyers will expect virtual access to events. They will want pithy, to-the-point digital content, especially video. They will expect companies to share insights online and conduct virtual demos.

It will become harder for sellers to secure in-person meetings. The logistics of providing building access, securing a conference room and rallying a group of people to meet in-person will seem illogical when within a few key strokes the same group of people can join a video conference.

Buyers will not wait for an in-person appointment with a technical specialist. They will expect companies to be able to remotely solve most problems, whether via chat, video or self-service portal.

Buyers have seen the quality of engagement the Digital Revenue Organization can deliver. They also know that these experiences will improve.

Buyers will want:

Virtual Access to Events

Video Conference Calls

Problems Resolved Virtually

SELLERS

Sellers often yearn for the road. There may be complaints of flights, drive time and hotel nights, but deep down inside they love it. The loyalty program status, the thrill of the big meeting and winning the deal—the fuel that keeps the fire burning.

Who can blame them? This is all they’ve known. Many have operated this way for a career. They have years of proof points that in-person works. Pair this with high pay at risk, there is little incentive to change.

The pandemic forced sellers into a new way of establishing, building and maintaining relationships. Sellers are investing time to develop digital skills and learning how to effectively deploy new tactics. Their customers are responding to the new world of digital engagement in a positive way. These sellers already recognize the benefits of having time back to think strategically about their pipeline, territories and relationships. Not lost is the benefit of more time to invest in family, friends and personal interests.

The market disruption has also impacted the employee value proposition. Sellers will expect flexibility and decision-making autonomy. They may not accept legacy ways of working. The dogmatic views of the past will be met with resistance.

This downturn created a new employee value proposition.

FINANCE

The disruption drove organizations to lean on scalable resources with the ability to execute in a remote environment. Digital marketing managers, lead generation and qualification representatives, inside (digital) sales and virtual technical support are just a few of the roles that have been integral to maintaining momentum.

Financial leaders have seen the benefit of a remote work force. IT leaders have addressed security issues and maintained budgets for technology projects that enable a remote work force. Marketing and sales expenses related to events, customer entertainment and in-person sales pursuits were paused. Real-estate and related infrastructure expenses were suddenly up for debate.

CFOs now have a base case showing the cost benefits of operating a remote work force and a worst case top-line impact. Budgets will be heavily scrutinized and revenue leaders will be challenged to maintain the winning practices of the more scalable and efficient operating model.

Classic arguments used to resist aspects of the Digital Revenue Organization no longer hold weight. Arguments around buying preferences, risks of competitive encroachment and others have been disproven.

The Digital Revenue Organization – A New Operating Model

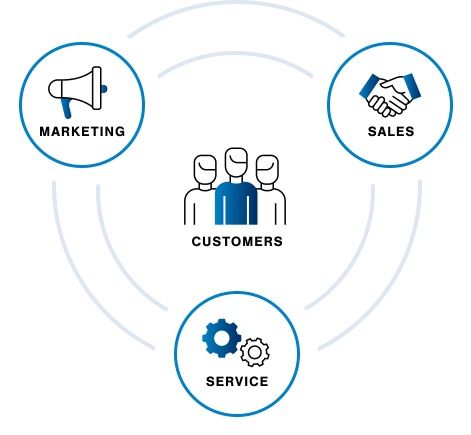

The Digital Revenue Organization is buyer journey centric, data driven, technologically adept and functionally aligned. The operating model features marketing, sales and service teams aligned through integrated systems, data and seamless process. Customer interactions are personalized and increasingly digital. The new operating model features fundamental changes to the way marketing, sales and service organizations engage with customers.

The Digital Revenue Organization

The Digital Revenue Organization – Marketing

Hybrid Events

Change

Events are hybrid, in-person and virtual. Virtual attendance at in-person events is offered at a reduced rate or complementary. Select sessions are live streamed and event content offered via an intuitive mobile application or online portal. Virtual attendees interact via captive social networks and livechat features.

Impact

- Increase in attendance because entry costs are eliminated or reduced

- Enriched attendee experience

- Track and leverage data to improve attendee experience, expand audience and attract sponsors

- Increase access to attendees for event sponsors, improving return on event costs

- Increase lead generation effectiveness, capturing personalized data from attendees

Social Media

Change

Limited in-person access persists. Inboxes are flooded. B2B marketers look to social as means to enrich customer interaction. Lead generation strategy and tactics include a social pillar to

complement digital advertising, email and event marketing.

Impact

Migrate headcount budgets to roles responsible for engaging with communities (social medial specialist) and generating content (content specialist)

Shift advertising and campaign budgets to target communities of interest

Scale Marketing’s social capabilities across the sales and service organization via training and talent cross-pollination

Content

Change

Not only is content offered in multiple forms and formats, but it’s personalized and relevant to the buyer and the stage of their journey. Companies invest in headcount and technology to feed the insatiable appetite for relevant, personalized content.

Impact

- Onboard new talent that can leverage technology and produce multi-media content

- Invest in content management platforms and data to activate account based marketing plays and use cases

- Connect internal systems to collect and democratize buyer journey data

- Leverage insights to deliver personalized content and messaging

The Digital Revenue Organization – Sales

New and Evolved Sales Roles

Change

Office and field-based roles become better enabled with data and technology. Job descriptions and leading indicators of success reflect a new way of selling. New versions of traditional roles are launched with technology as their primary means of customer engagement.

Impact

Alleviate sellers’ time requirements in the field or number of in-person meetings

Shift leading indicators of pipeline productivity to social media engagement, number of quality conversations (virtual or in-person), and others

Reclassify Inside Sales as Digital Sales

Track usage and tool adoption to understand enablement ROI

Customer Engagement

Change

Companies invest in more sophisticated collaboration platforms and train sellers on how to run high impact customer engagements. Use of green screens, data, digital whiteboards, video and other high impact features become common place. Remote sales meetings become the preferred means of engagement by both customers and sellers.

Impact

Establish office or in-home technology setups for sellers, including multiple screens, high quality microphones and HD cameras

Enable sellers through multiple screens to leverage selling aids and data seamlessly

Find new ways to create personal connections through small touches such as personal pictures, virtual backgrounds, waving goodbye and others

Use green screens and virtual backgrounds to enhance the experience and have fun

Minimize technical pre-sales travel to customer sites and instead engage virtually via tablet or in-room video

Launch virtual demos and PoCs with the use of video, digital studios and AR/VR

Talent and Skills

Change

Human resource leaders recognize that digital transformation is not only about acquiring technology and evolving the go-to-customer model. It’s also about talent. Sellers are immersed in a new suite of training to prepare them to operate in a remote, technology and data driven environment. Sellers become savvy users of video, text and social media. They figure out how to leverage their charisma and likeability in a virtual interaction.

Impact

Shift training budgets from sales methodology training to digital and social skills to help sellers make the transition

Focus recruiting efforts on seeding the organization with experienced digital sellers

Ensure tenured sellers begin demonstrating remote or digital selling best practices (e.g., higher EQ as well as video and social media etiquette)

Use technology and data to prepare and execute sales calls proliferates

Differentiate sellers’ technical skills and product knowledge through digital relationship development

Management Cadence

Change

Managers serve as early adopters of new collaboration technology. They incorporate data visualization and analytics into their team interactions and leave static presentations, reports and workbooks behind. They manage to new metrics.

Impact

Conduct shorter, more frequent team interactions (e.g., weekly)

Turn video on at all times

Coach sellers to execute a more sophisticated mix of customer engagement (e.g., email/phone/text/social) and encourage proactive delivery of customized content to matriculate pipeline

Celebrate social media views/likes and high volumes of quality engagements as if they are an outright win

Use internal social media platforms to celebrate success and “ring the bell”

The Digital Revenue Organization – Service

Self-Service

Change

Companies prioritize digital transformation within the service organization to improve customer experience and scale. Online customer portals with access to account information, order history, billing details, frequently asked questions, how-to videos and training tools proliferate.

Impact

Protect IT budgets earmarked for service organization transformation

Produce content (e.g., videos) that is posted on social media and corporate websites to promote self-service

Develop full-scale platforms with customer logins and personalized experiences

Invest in training customers to use portals (includes dissuading phone based interaction)

Reduce phone based headcount, reinvesting in select resources (e.g., chat or email-based roles)

Differentiate service levels based on support programs or loyalty programs

Customer Success

Change

Companies across industries apply scalable proactive engagement with customers as a core pillar of growth. Customer success manager hiring ramps. Jobs are built around a data driven set of plays known to improve customer experience, solution adoption, cross-sell/upsell and renewal.

Impact

Use business intelligence to identify types of customer engagement correlated with loyalty and expansion

Build data lakes that aggregate purchasing, accounts receivables, marketing engagement, online portal activity and other data

Create collaboration between data scientists and customer success leadership to architect and scale plays

Build out large scale office-based teams to alleviate cost-to-serve

Automate plays on low volume or low opportunity accounts through marketing automation and related systems

Virtual Technical Support

Change

Companies scale their investment in highly technical, hard to find talent through the use of video and produced content. Field based resources are brought inside and armed with technology (e.g., digital studios, collaboration tools, video and augmented reality/virtual reality) to address customer needs.

Impact

Digitally market the value of preventative maintenance and self-service to improve total cost of ownership

Direct customers to online portals, mobile applications or websites to book appointments. Use self-service video content as an alternative

Give customers the option of a video consultation before a live technician is dispatched

Redesign service contracts to include higher costs for live service and free or heavily discounted virtual service

Conclusion

The Digital Revenue Organization is here to stay. Vendors and customers are experiencing the benefits of the new operating models. Marketing, sales and service motions have fundamentally changed—for the better.

Undoubtedly, some companies will resist, trying to differentiate by committing to in-person experiences. They will lambaste the digital movers. These companies will not survive.

The winners will bring the value of live customer engagement into a digital world. Their ability to create a seamless buying experience digitally will render the in-person ways of the past obsolete. These leaders will fundamentally change

customer expectations.

Team members will need to continue developing new skills to succeed in this new normal, challenging themselves past uncomfortableness and leaving the dogmatic ways of operating in the past. Leaders will need to continue down this new path, using this moment as the fuel to invest for a future of growth.

Contact us to discuss how you can accelerate your own digital transformation.

Proven Methodology to Accelerate Sales

The Digital Revenue Organization: A Post-Pandemic Perspective

How Data Is Changing Revenue Growth

About Alexander Group

Alexander Group understands your revenue growth challenges. Since 1985, we’ve served more than 3,000 companies across the globe. This experience gives us not only a highly sophisticated set of best practices to grow revenue—we also have a rich repository of unique industry data that informs all our recommendations. Aligning product, marketing, operations and finance efforts behind a successful sales organization takes insight and hard work. We help the world’s leading organizations build the right revenue vision, transform their organizations and deliver results.