Thriving in Complexity

Business models are becoming more complex, as a reflection of massive shifts in the business environment.

Customers have heightened expectations for speed and delivery, adding to the mandate for an exceptional customer experience. Technological advances are breaking down barriers to entry, allowing new competitors to capture niche markets. These pressures leave companies with an identity crisis, wondering which new offerings will appeal to existing customers and to emerging markets alike.

Business Services organizations are in a state of significant transformation. The pressure to evolve from a simplistic, labor-driven business model to one that integrates technology and meets new buyer requirements is growing. As a result, leaders must now determine how to sustain existing customers with new solutions and intelligently land new market opportunities.

This whitepaper identifies critical areas for leaders in Business Services organizations to capture emerging markets while upscaling existing customers.

Sizing the Prize Starts with Opportunity Modeling

Understanding market potential is the first step in a successful sales plan. Attention to detail is essential, including defining market opportunity size, customer segments and competition. In essence, business services must understand why they are in business, to whom do they sell, and where they fit in the competitive landscape.

Start by having a tactical target that includes account assignments, giving sales representatives direction and goals. Without clear targets in the market, companies cannot measure results or gauge if their plan is successful.

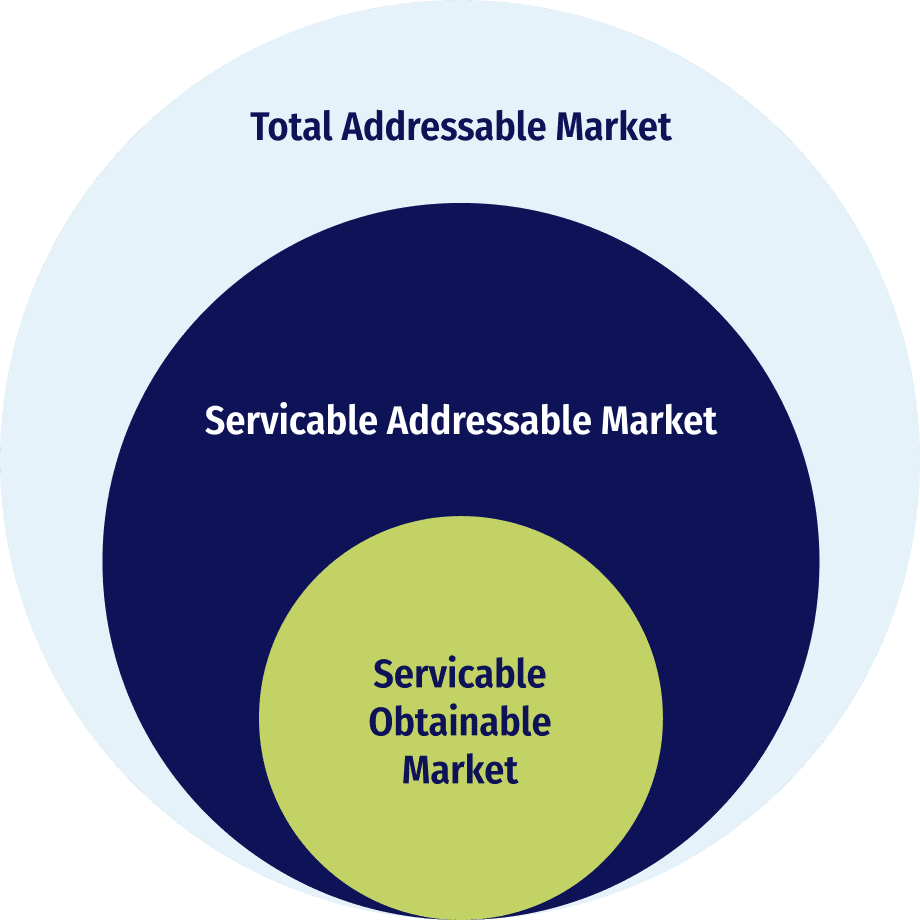

Working with clients, Alexander Group assesses the size and strength of sectors. The precise use of data is necessary to calculate the entire market and ensure market opportunity. First, filter out the percentage of the market locked out by regulatory issues or a dominating competitor’s market share, with total addressable market (TAM) as the remaining percentage. If the organization is mature, they often own part of the market share of the TAM, but what is leftover is the prize – untapped opportunity.

Data analytics provide unique insights into the market, and in assisting with the evaluation of opportunities. The Alexander Group typically recommends using three to four buyer profile criteria, weighting each to come up with a score. Criteria may include historical revenue, employees, industry vertical and other elements that help a Business Services organization evaluate segment opportunity. Then, as an iterative process, leaders combine weighted criteria and subjective inputs to arrive at a score to use as the basis for their sales plan.

Using scores from the prioritization of targets, leaders can establish sales motions and sales compensation programs that create momentum for growth. For example, Alexander Group often works with clients to evaluate their business vision, strategy and sales motions to go after untapped opportunities, including a review of the market size and the annual or semi-annual potential.

This opportunity modeling exercise creates a practical and prioritized list of accounts for sellers. By creating targets, leaders can assign workloads and prioritize the focus within each rep’s list of accounts. In addition, this data-centric approach is welcome by sellers, and motivates them in creating plans for greater productivity.

Mapping the Go-to-Market Strategy

Sizing the market is essential but requires additional analysis before determining the appropriate tactics to approach buyers. Validating buyers’ needs and intent, mapping out the product and service offerings that address those needs, and developing a competitive value proposition are all prerequisites to a successful go-to-market (GTM) strategy.

Detail the buyer journey

Identify and validate any customer personas that serve as potential buyers, day-to-day users, or influencers in the purchasing process. Validate their individual needs, use cases, interests, and motivation for purchase; but also understand their journey to making a potential purchase. What prompted their inquiry? What information or research did they gather? Where did they gather this information? When and how do they prefer to engage with potential vendors? With an estimated 67-90% of a buyer’s journey complete before interacting with a sales representative (according to Forrester), organizations need to develop more content and deliver the right messaging to customers earlier in their buyer journey – not just at the final point of persuasion.

Define customer segments

Develop a customer segmentation model to better organize target markets and better clarify go-to-market priorities. Ideally, segment customers based on a combination of their 1) shared needs, 2) current spend, and 3) spend potential. Incorporating “common needs” into segmentation allows commercial teams to develop targeted messaging and ensure more meaningful customers interactions based on an understanding of the unique challenges of their segment (e.g., industry, job function, geography, growth stage, etc.). Layering in “account spend” and “spend potential” allows organizations to isolate and prioritize their most attractive targets, while also ensuring that commercial resources are appropriately balanced across target customers of all sizes.

Map products and services to use cases

Today’s most successful sales organizations are shifting away from communicating what they sell and instead focusing on the use cases they help address. This shift is driven by organizations mapping their offerings back to the unique customer challenges they help solve, rather than leading with the depth and breadth of their offerings. This mapping exercise will not only pressure-test the completeness of an organization’s capabilities, but force leadership to clearly articulate how they will help customers. The result is more compelling, customer-centric messaging and better clarity regarding competitive fit and capabilities for the commercial organization.

Create a compelling value proposition

Strong value propositions are simple to communicate, anchored to a clear benefit, and able to differentiate an organization as the preferred vendor. By layering in competitive research and customer case studies, organizations can develop content and messaging that resonates with buyers at all stages of their journey—from the earliest days of a prospect’s research through the renewal and extension of legacy customer relationships. This not only informs marketing strategy and priorities, but sales scenario-specific plays and messages that can be executed on a recurring basis.

Mapping buyers, offerings, and value propositions form the foundation for each organization’s GTM strategy; setting the stage for which sales motions will be most successful.

Determining the Right Sales Motion

Once a Business Services organization understands its market potential and GTM strategy, it can determine which sales motions will support each buyer-offering-value proposition combination.

There are three basic types of sales motions that require different seller expectations and competencies.

Sales Fulfillment

Fulfillment is a transactional motion where the seller must accurately present an offering to a buyer—either in a one-time transaction or on ongoing basis after developing a customer relationship.

Sales Advocacy

The seller acts as a consultative guide, helping the buyer determine which product or service best fits a buyer’s need. Sellers are expected to provide advice, education, and ROI assurances to help facilitate a purchasing decision. Advocates include field reps, customer success managers, account managers or even specialists that promote the offering.

Sales Innovation

In this more complex sales motion, sellers contribute significantly to the design of a new or bespoke customer solution.

Alexander Group’s research finds that while many organizations require multiple sales motions, individual sellers are typically proficient at only one or two of these motions. By acknowledging the required sales motion(s), organizations can design more effective sales processes and determine the commercial talent profiles, sales skills and competencies required to successfully execute the GTM strategy.

Driving Profitable Revenue Growth by Customer Type

Aligning opportunity, strategy and sales motions are dependent on what customer relationship the organization wants to form. A Business Services organization needs specific tactics to land new customers and expand opportunities with current customers.

Land New Customers

Digital strategies are a critical part of sales motions, especially for new accounts. Buyers explore more than ever before, collecting the data they need before reaching out to a vendor. Companies must position their information to support the lead identification and engagement tactics of the land strategy. Firms are increasing engagement earlier in the buyer’s research process by coupling digital marketing with business development, lead generation, and web-based chat functions. This is reflected in the fact that of the 80% of leaders planning to increase marketing investment; marketing AI and analytics, automation, pull content development are cited as the top three marketing investment areas and priorities.

Retain and Expand Existing Customers

While pay-as-you-go consumption and subscription-based revenue models are not a new concept, their growth in recent years has forced traditional business service organizations to rethink how to retain and expand their existing customer base. Driving incremental revenue in the post-land phase requires a greater focus on customer success via delivery of value, insights and proof of results.

Customer retention and expansion has become a team sport; forcing organizations to overcome department silos and put the buyer at the center of their business model. In recent years, Alexander Group has seen a dramatic increase in the number of relationship manager and customer success roles being deployed. In recent Alexander Group research, Business Service leaders cited Customer Success as the top investment area for their post-sale service functions. These resources, in concert with traditional sales representatives, require a higher level of coordination and support to expand the opportunity within the existing customer base.

Sales Compensation Aligned to Business Strategy

Once a Business Services organization determines their GTM strategy, they are ready to develop a sales compensation plan that motivates sellers. Sequencing is important, and it’s essential to have the GTM strategy in place first, and to understand the market priorities and activities, before continuing on to plan design.

Alexander Group’s experience shows that sales compensation also reflects a company’s maturity level. Simply commission-based compensation plans, which are based on cost of sales are typical for new and fast-growing companies. However, as companies become more experienced, they will develop more sophisticated quota-based plans that achieve multiple objectives.

As selling becomes more of a team sport, it is important to reward those who contribute to the selling process across the organization. Account managers, customer success managers and service reps all contribute to landing and expanding accounts. In these situations, Alexander Group’s research shows that 80-90% of organizations with customer-facing roles employ quota-based compensation plans.

The lagging indicator of quota attainment is an important driver of plan design. Alexander Group’s research shows that on average of 55-65% of sellers meet or exceed their quota. Historical quota attainment data is critical in understanding a company’s ability to set goal and allocate quotas. This ability needs to align with the overall plan design, and especially with the formulation of the payout curves.

Next Steps for Sales Success

Driving profitable growth requires a clear business vision backed by proven strategies and tactics. To get started building a successful sales model, follow these steps.

Develop a vision that reflects current business trends

Companies are evolving their vision to reflect new customer, technology and competitive pressures in their environment. Growth leaders are placing the customer at the center of their business model to ensure that buyer solutions, not products, are the focal point.

Understand buyer intentions

Companies now invest in data analytics to track and measure every step of the buyer journey. Combining analytics with front-line experience indicates what a buyer’s intentions are and how to influence those intentions at every stage of the journey.

Make digital investments that align with the business vision

Haphazard technology investments will prevent an organization from identifying and reaching new opportunities. Business Services firms must align digital investments and roles across the organization, contributing insights from customer-facing and support departments. These data points drive the play for the sales organization, indicating what steps are needed to land and expand customers.

Craft unique messaging used by customer-facing departments

Buyers look to personalized messaging that reflects their purchase behavior. Generic messaging, or conflicting messaging used across departments, creates friction and deteriorates the customer experience. Sales, Marketing, Support and Service should clearly convey the value proposition.

Align talent to new roles

As new job roles emerge in the organization, ensure that the right talent is used to fill those roles. Growth leaders invest in training that conveys who the customer is, what products they can use, and what systems are in place to support the sale.

Unleashing Growth

Alexander Group works closely with Business Services revenue leaders to identify critical actions for profitable growth. Experience shows that these leaders can miss untapped potential unless they have a clear GTM strategy, backed by aligned sales motions and appropriate compensation. We’re ready to help you build a solid GTM model.

Business Services Overview: Rethink Your GTM Model

Business Services Insights

Upcoming Business Services Events

About Alexander Group

Alexander Group understands your revenue growth challenges. Since 1985, we’ve served more than 3,000 companies across the globe. This experience gives us not only a highly sophisticated set of best practices to grow revenue—we also have a rich repository of unique industry data that informs all our recommendations. Aligning product, marketing, operations and finance efforts behind a successful sales organization takes insight and hard work. We help the world’s leading organizations build the right revenue vision, transform their organizations and deliver results.